Markets Have Fantastic Second Quarter

Global equity markets had a fantastic second quarter – especially the tech names. But toward the end of the quarter, the rally really started to broaden out, as underscored by the large-cap S&P 500 recording its biggest quarterly gain since late 2021.

For the second quarter of 2023:

The DJIA advanced 3.4%;

The S&P 500 gained 8.3%;

NASDAQ jumped 13.1%; and

The Russell 2000 added 4.8%.

Besides there being a lot to celebrate when the quarter closed, investors were also paying attention to the year’s mid-way point as:

The S&P 500 is up more than 16% YTD and turned in its best first half since 2019;

NASDAQ is up an astonishing 31%+ YTD on its way to its best half since 1983; and

The DJIA turned in a much more modest 3.9% YTD gain.

The themes that drove market performance in the second quarter continued to center around inflation, the Fed, and the labor market, as recent numbers suggested that inflation is easing as the Fed paused its rate-hiking trend (at least for now). There was also a lot of encouraging economic data received this quarter as well, including a revised GDP number.

Further, we saw that:

Volatility, as measured by the VIX, trended down this quarter, beginning the quarter at 18.70 and ending at 13.59, never breaching its beginning-of-the-quarter high.

West Texas Intermediate crude also trended down for the quarter, starting at just over $75.57/barrel and ending the quarter at $70.45, with a brief spike early in the quarter to more than $83/barrel.

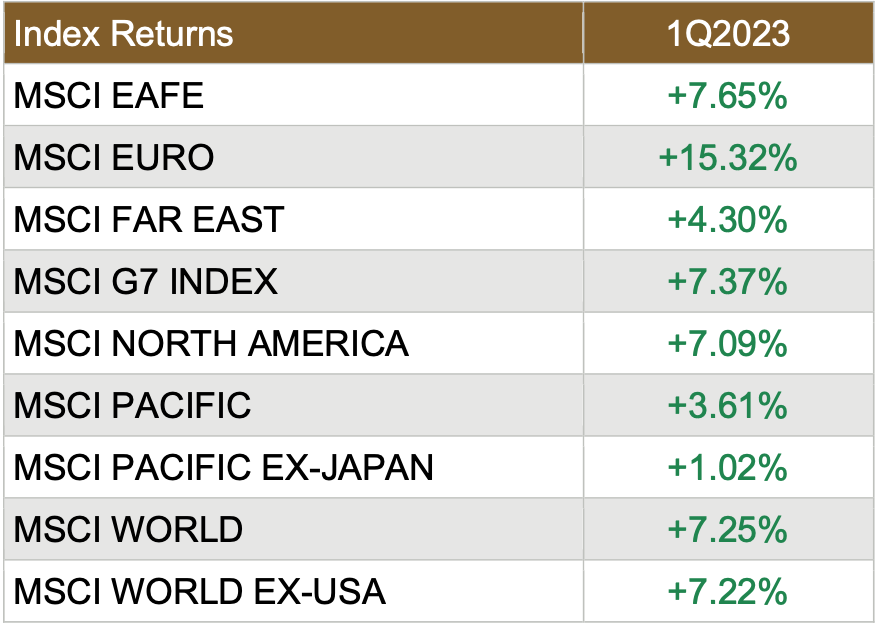

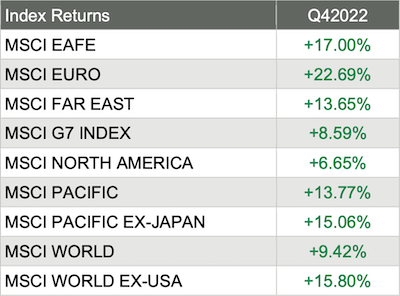

Market Performance Around the World

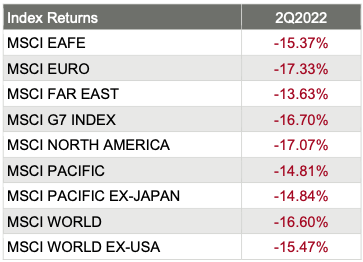

Investors were happy with the quarterly performance around the world, as all 32 of the 36 developed markets tracked by MSCI were positive for the second quarter of 2023, with 13 jumping more than 6%. And for the 40 developing markets tracked by MSCI, only 23 of those were positive, although 2 leapt more than 15% (MSCI Eastern Europe and MSCI Eastern Europe ex-Russia).

Source: MSCI. Past performance cannot guarantee future results

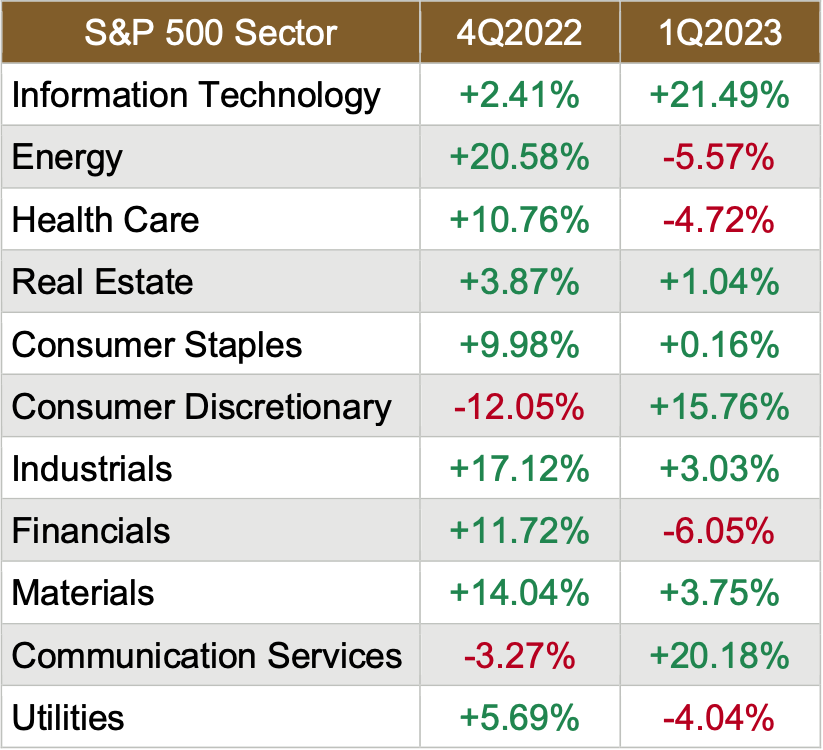

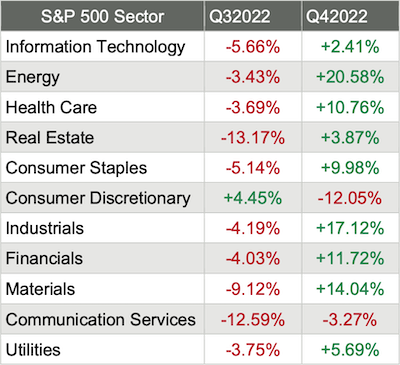

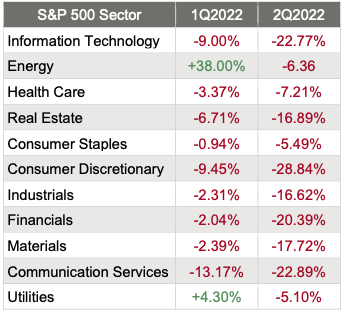

Sector Performance Rotated in 2Q2023

The overall performance for sector performance for the second quarter of 2023 was very good, as 9 of the 11 sectors advanced, with 3 jumping more than 15% . Compared to last quarter’s performance, this quarter was much better, as last quarter saw only 7 painted green.

And interestingly, this past quarter was eerily similar to the 4th quarter of last year, which also saw 9 advance, including 6 of those jumping by double-digits. Here are the sector returns for the second and first quarters of 2023:

Source: FMR

Reviewing the sector returns for just the 2nd quarter of 2023, we saw that:

9 of the 11 sectors were painted green, with the Information Technology and Consumer Discretionary sectors making big leaps;

The defensive-sectors (think Utilities and Energy) struggled during the quarter;

Financials rebounded on the heels of last quarter’s struggles which were driven by two significant bank failures; and

The differences between the best (+20%) performing and worst (-2%) performing sectors in the first quarter was massive.

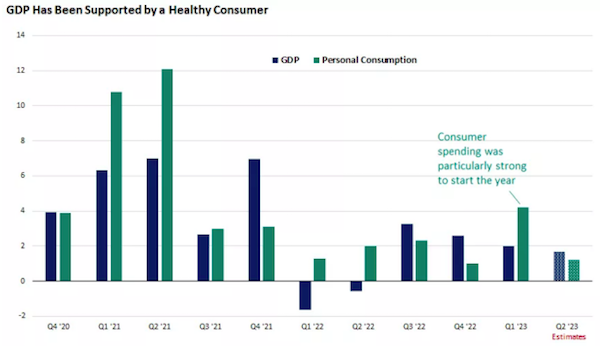

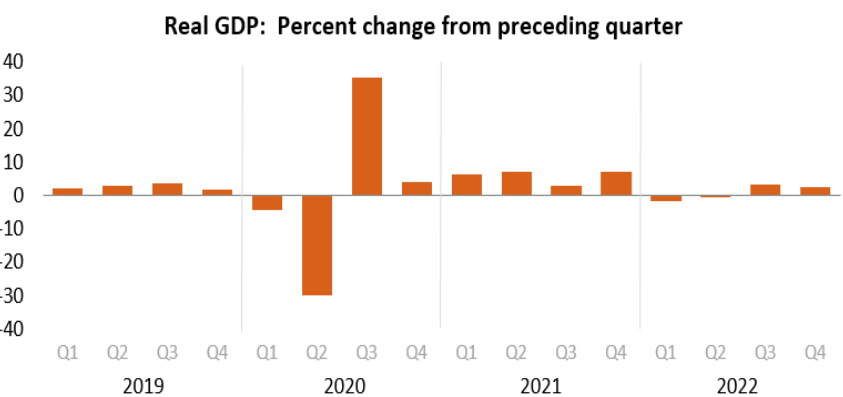

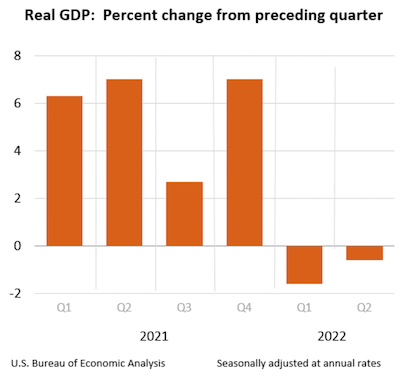

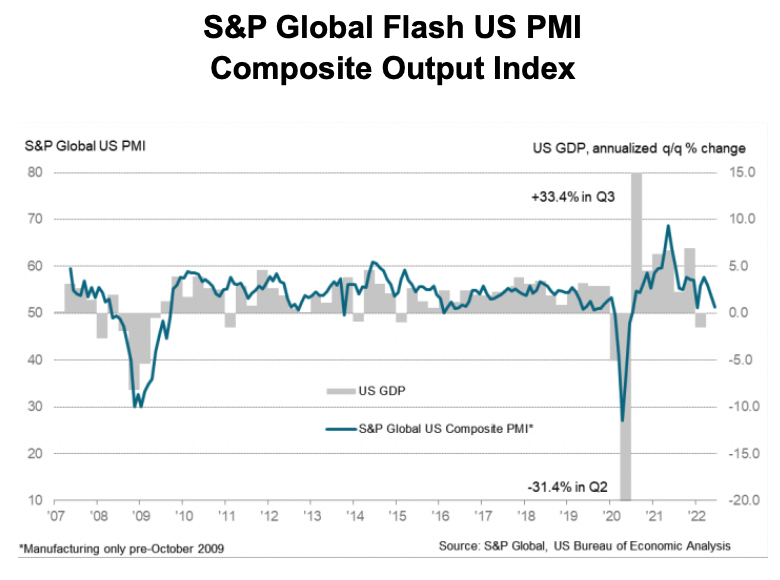

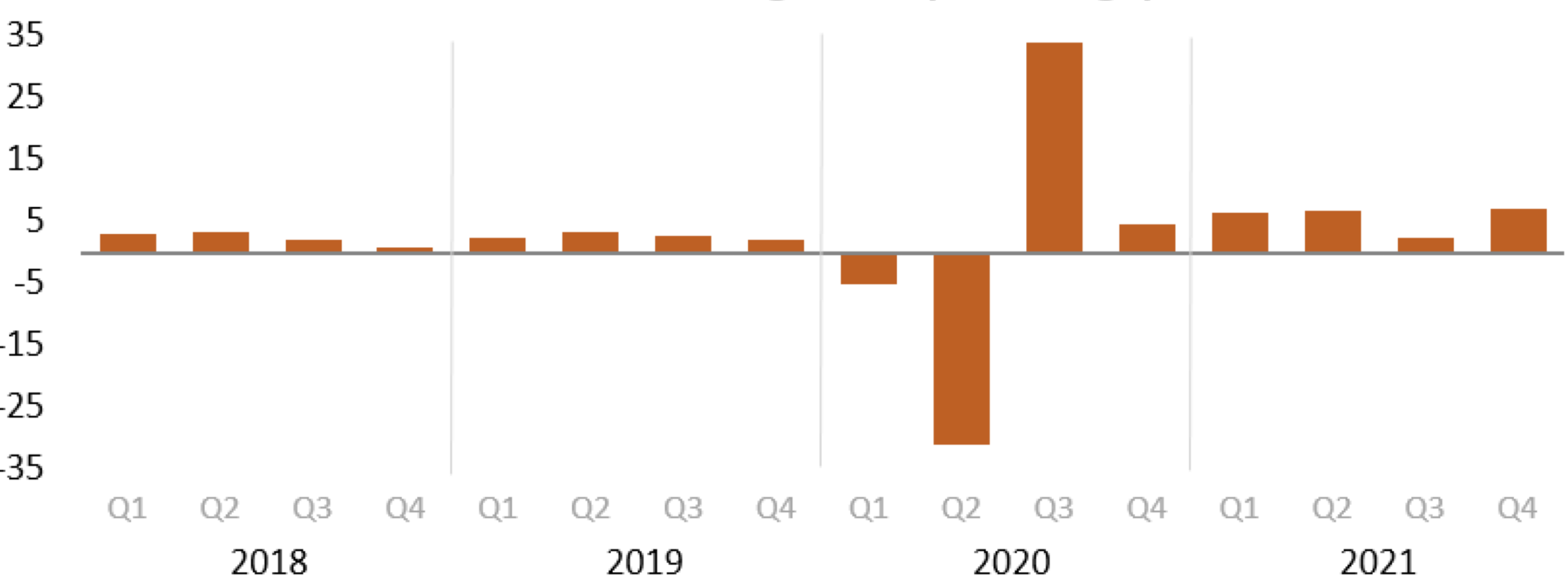

1Q2023 GDP Revised Up

As the quarter came to a close, the Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at an annual rate of 2.0% in the first quarter of 2023. In the fourth quarter, real GDP increased 2.6%.

Here is one of the more interesting – and surprising – revelations from the BEA’s press release:

“The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.3%. The updated estimates primarily reflected upward revisions to exports and consumer spending that were partly offset by downward revisions to nonresidential fixed investment and federal government spending. Imports, which are a subtraction in the calculation of GDP, were revised down.”

Further:

“The increase in real GDP in the first quarter reflected increases in consumer spending, exports, state and local government spending, federal government spending, and nonresidential fixed investment that were partly offset by decreases in private inventory investment and residential fixed investment. Imports increased.

Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected a downturn in private inventory investment and a slowdown in nonresidential fixed investment that were partly offset by an acceleration in consumer spending, an upturn in exports, and a smaller decrease in residential fixed investment. Imports turned up.

Current-dollar GDP increased 6.1% at an annual rate, or $391.8 billion, in the first quarter to a level of $26.53 trillion, an upward revision of $43.5 billion from the previous estimate.

The price index for gross domestic purchases increased 3.8% in the first quarter, the same as the previous estimate.

The personal consumption expenditures (PCE) price index increased 4.1%, revised down 0.1%. The PCE price index excluding food and energy prices increased 4.9%, a downward revision of 0.1%.

Personal Income

Current-dollar personal income increased $278.0 billion in the first quarter, an upward revision of $26.7 billion from the previous estimate. The increase primarily reflected increases in compensation (led by private wages and salaries) and personal current transfer receipts (led by government social benefits).

Disposable personal income increased $587.9 billion, or 12.9 percent, in the first quarter, an upward revision of $26.4 billion from the previous estimate. Real disposable personal income increased 8.5%, an upward revision of 0.7%.

Personal saving was $840.9 billion in the first quarter, an upward revision of $11.6 billion from the previous estimate.

The personal saving rate – personal saving as a percentage of disposable personal income – was 4.3% in the first quarter, an upward revision of 0.1%.”

Source: Bloomberg, Atlanta Fed GDPNow Estimates

Fed Keeps Rates Steady

Late in the quarter, the Federal Reserve announced that they would hold the official federal funds target rate to the 5.00% to 5.25% range, the first pause after 10 hikes in 14 months. But Wall Street is still betting on two more rate hikes before the year is over.

Fed Chair Jerome Powell then said multiple times that the policy committee had not made any decision about raising rates and that “any further moves would depend on incoming growth and inflation data.” This statement was interpreted as more dovish.

Then Powell said: “We've moved much closer to our destination, which is that sufficiently restrictive rate, and I think that means by almost by definition that the risks of sort of overdoing it and…underdoing it are getting closer to being in balance.”

Inflation Slows, But Core-Inflation a Worry

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers rose 0.1% in May on a seasonally adjusted basis, after increasing 0.4% in April. Over the last 12 months, the all items index increased 4.0% before seasonal adjustment.

“The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks. The food index increased 0.2 percent in May after being unchanged in the previous 2 months. The index for food at home rose 0.1 percent over the month while the index for food away from home rose 0.5 percent. The energy index, in contrast, declined 3.6 percent in May as the major energy component indexes fell.

The index for all items less food and energy rose 0.4 percent in May, as it did in April and March. Indexes which increased in May include shelter, used cars and trucks, motor vehicle insurance, apparel, and personal care. The index for household furnishings and operations and the index for airline fares were among those that decreased over the month.

The all items index increased 4.0 percent for the 12 months ending May; this was the smallest 12-month increase since the period ending March 2021. The all items less food and energy index rose 5.3 percent over the last 12 months. The energy index decreased 11.7 percent for the 12 months ending May, and the food index increased 6.7 percent over the last year.”

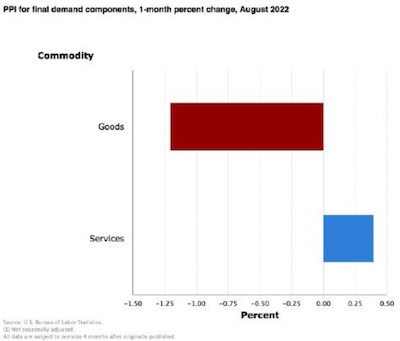

Then two days later, the Labor Department delivered more good news when it reported that the Producer Price Index dropped 0.3% in May.

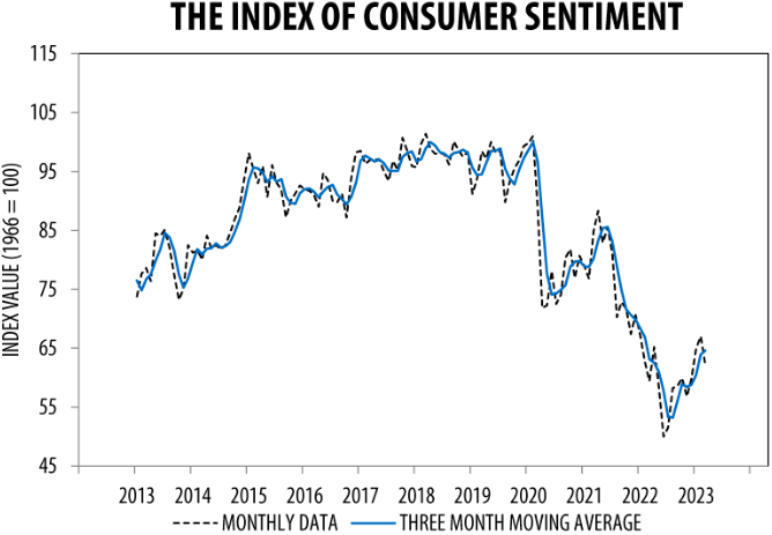

Consumer Sentiment Jumps

“Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook over the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then. As it stands, though, sentiment remains low by historical standards as income expectations softened. A majority of consumers still expect difficult times in the economy over the next year.

Year-ahead inflation expectations receded for the second consecutive month, falling to 3.3% in June from 4.2% in May. The current reading is the lowest since March 2021. In contrast, long-run inflation expectations were little changed from May at 3.0%, again staying within the narrow 2.9-3.1% range for 22 of the last 23 months. Long-run inflation expectations remained elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

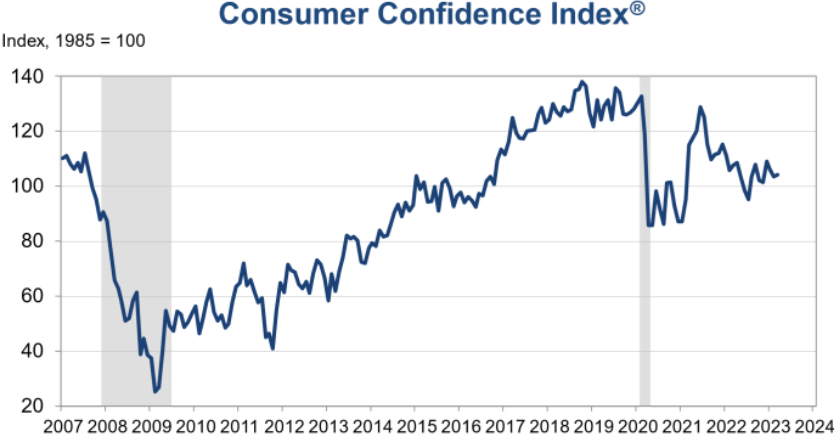

Global Investor Confidence Index Up Again

State Street Global Markets released the results of the State Street Investor Confidence Index for June 2023 and announced the following:

“The Global Investor Confidence Index increased to 95.8, up 6.1 points from May’s revised reading of 89.7. The increase in Investor confidence was led by a 4.9 point rise in North American ICI to 90.0 as well as a 5.0 point rise in European ICI to 104.9. Asian ICI, meanwhile, dropped 4.3 points to 96.7”

Global Investor Confidence Index

“Investor confidence was once again stronger in June, with the Global ICI improving for the 6th consecutive month, a streak that has only been replicated once (in 2009) in the 25 years since the creation of the index. While confidence has rallied smartly since the start of the year, it remains below neutral, signaling a continued defensiveness towards overall risk allocations. The North America ICI reading continued to improve as the resolution of the debt ceiling debate removed a significant market risk from the radar. The Europe ICI was also stronger on the month, returning to risk seeking territory as it records the highest reading amongst the regions we track. Finally, Asia investor confidence deteriorated back below neutral as China continues to experience a bumpy post Covid recovery.”

Small Businesses Feeling Optimistic

The National Federation of Independent Businesses reported that “the NFIB Small Business Optimism Index increased 0.4 points in May to 89.4, which is the 17th consecutive month below the 49-year average of 98. The last time the Index was at or above the average was in December 2021. Small business owners expecting better business conditions over the next six months declined one point from April to a net negative 50%. Twenty-five percent of owners reported that inflation was their single most important problem in operating their business, up two points from last month and followed by labor quality at 24%. Key findings include:

Forty-four percent of owners reported job openings that were hard to fill, down one point from April and remaining historically very high.

The net percent of owners raising average selling prices decreased one point to a net 32% (seasonally adjusted), still an inflationary level but trending down.

The net percent of owners who expect real sales to be higher deteriorated two points from April to a net negative 21%.”

Job Openings Still Hard to Fill

Further, as reported in the NFIB’s monthly jobs report:

Owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 19% planning to create new jobs in the next three months.

Overall, 63% of owners reported hiring or trying to hire in May, up three points from April.

Of those hiring or trying to hire, 89% of owners reported few or no qualified applicants for their open positions.

In addition:

A net 41% of owners reported raising compensation, up one point from April.

A net 22% plan to raise compensation in the next three months, up one point.

Ten percent of owners cited labor costs as their top business problem.

24% said that labor quality was their top business problem.

Leading Indicators Decline Again

The Conference Board announced that its Leading Economic Index (LEI) for the U.S. declined by 0.7% in May 2023 to 106.7 (2016=100), following a decline of 0.6% in April. The LEI is down 4.3% over the sixmonth period between November 2022 and May 2023 – a steeper rate of decline than its 3.8% contraction over the previous six months from May to November 2022.

Directly from the release: “the US LEI continued to fall in May as a result of deterioration in the gauges of consumer expectations for business conditions, ISM New Orders Index, a negative yield spread, and worsening credit conditions. The US Leading Index has declined in each of the last fourteen months and continues to point to weaker economic activity ahead. Rising interest rates paired with persistent inflation will continue to further dampen economic activity.

While we revised our Q2 GDP forecast from negative to slight growth, we project that the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending.”

Further, the Conference Board Coincident Economic Index (CEI) for the U.S. increased by 0.2% in May 2023 to 110.2 (2016=100), after rising by 0.3% in April. The CEI is now up 0.8% over the six-month period between November 2022 and May 2023— down slightly from the 0.9% growth it recorded over the previous six months. The CEI’s component indicators—payroll employment, personal income less transfer payments, manufacturing trade and sales, and industrial production—are included among the data used to determine recessions in the US. While recent data for industrial production have contributed negatively to coincident index, sales, employment, and income growth remained positive.

Finally, the Conference Board Lagging Economic Index (LAG) for the U.S. increased by 0.1% in May 2023 to 118.4 (2016 = 100), reversing a decline of 0.1% in April. The LAG is up 0.6% over the six-month period from November 2022 to April 2023, much slower than its growth rate of 3.3% over the previous six months.

The annual growth rate of the US LEI remained negative, continuing to signal weakening growth prospects

Negative contributions to the LEI were widespread among both financial and non-financial components

Source: The Conference Board

*Inverted series: a negative change in this component makes a positive contribution

**Statistical imputation

LEI change is not equal sum of its contributions due to application of trend adjustment factor

The US LEI continues to signal a recession within the next 12 months

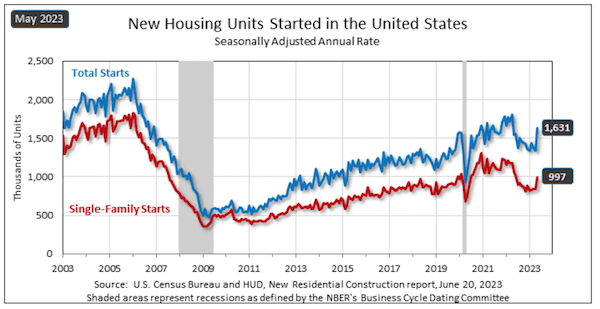

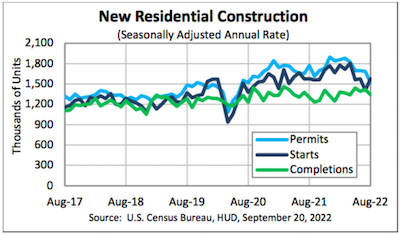

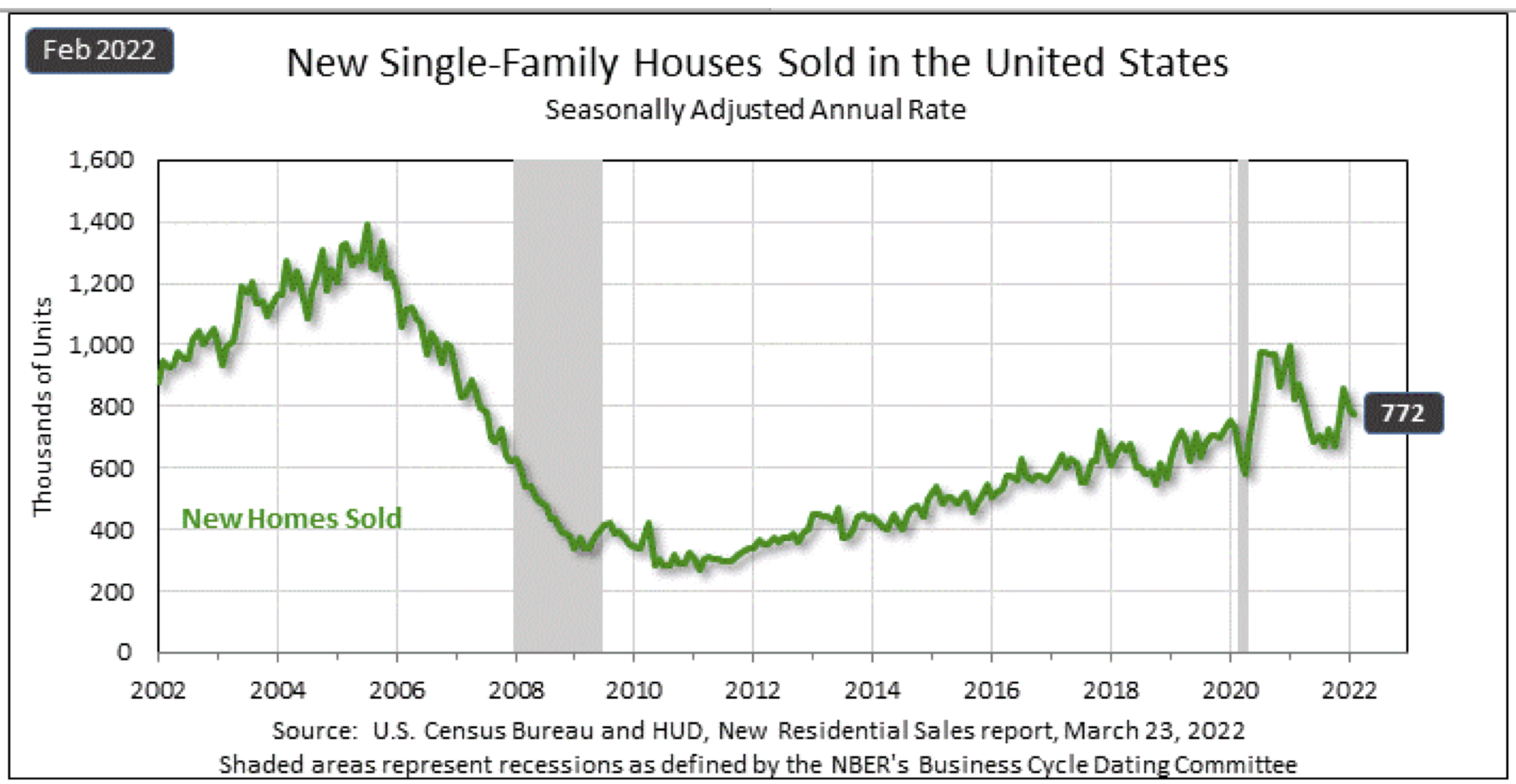

Housing Showing Signs of Momentum

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential construction statistics for May 2023:

Building Permits

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,491,000.

This is 5.2% above the revised April rate of 1,417,000.

This is 12.7% below the May 2022 rate of 1,708,000.

Single‐family authorizations in May were at a rate of 897,000.

This is 4.8% above the revised April figure of 856,000.

Authorizations of units in buildings with five units or more were at a rate of 542,000 in May.

Housing Starts

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,631,000.

This is 21.7% above the revised April estimate of 1,340,000.

This is 5.7% above the May 2022 rate of 1,543,000.

Single‐family housing starts in May were at a rate of 997,000

This is 18.5% above the revised April figure of 841,000.

The May rate for units in buildings with five units or more was 624,000.

Housing Completions

Privately‐owned housing completions in May were at a seasonally adjusted annual rate of 1,518,000.

This is 9.5% above the revised April estimate of 1,386,000.

This is 5.0% above the May 2022 rate of 1,446,000.

Single‐family housing completions in May were at a rate of 1,009,000; this is 3.9% above the revised April rate of 971,000.

The May rate for units in buildings with five units or more was 493,000.

Manufactured Durable Goods Up in May

The U.S. Census Bureau announced the May advance report on durable goods manufacturers’ shipments, inventories and orders:

New Orders

New orders for manufactured durable goods in May, up three consecutive months, increased $4.9 billion or 1.7% to $288.2 billion.

This followed a 1.2% April increase.

Excluding transportation, new orders increased 0.6%.

Excluding defense, new orders increased 3.0%.

Transportation equipment, also up three consecutive months, led the increase, $3.9 billion or 3.9% to $102.6 billion.

New Orders Over the Past 12 Months

Shipments

Shipments of manufactured durable goods in May, up two of the last three months, increased $4.8 billion or 1.7% to $282.7 billion. This followed a 0.6% April decrease. Transportation equipment, also up two of the last three months, led the increase, $4.0 billion or 4.6% to $91.8 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in May, up five of the last six months, increased $10.6 billion or 0.8% to $1,302.0 billion. This followed a 0.8% April increase. Transportation equipment, also up five of the last six months, drove the increase, $10.8 billion or 1.4% to $803.9 billion.

Inventories

Inventories of manufactured durable goods in May, up five of the last six months, increased $1.2 billion or 0.2% to $522.9 billion. This followed a 1.0% April increase. Machinery, up thirty-one consecutive months, led the increase, $0.5 billion or 0.5% to $94.4 billion.

Capital Goods

Non-defense new orders for capital goods in May increased $5.7 billion or 6.7% to $91.0 billion. Shipments increased $2.7 billion or 3.4% to $82.9 billion. Unfilled orders increased $8.1 billion or 1.1% to $748.7 billion. Inventories increased $0.1 billion or 0.1% to $225.5 billion. Defense new orders for capital goods in May decreased $2.7 billion or 14.7% to $15.9 billion. Shipments decreased $0.2 billion or 1.2% to $13.2 billion. Unfilled orders increased $2.7 billion or 1.3% to $213.6 billion. Inventories increased $0.1 billion or 0.2% to $24.2 billion.