Global Market Commentary: Third Quarter 2022

Markets Have Awful Third Quarter

Global equity markets had an awful third quarter, and when the final Wall Street bell weakly tolled on Friday, September 30th, all major global equity markets were in the red, leading to overall market declines not seen in decades.

Further, entering the fourth quarter of 2022, the DJIA and S&P 500 are both at their lowest since November 2020, while NASDAQ is at its lowest since the end of July 2020.

For the third quarter of 2022:

The DJIA dropped 6.7%;

The S&P 500 lost 5.3%;

NASDAQ lost 4.1%; and

The Russell 2000 declined by 3.6%.

The themes that drove market performance in the third quarter were the same worries that drove markets in the first two quarters and toward the end of last year. And the two most dominant themes continue to be inflation and the Fed – with the former rising to 40-year highs and the latter causing Wall Street to worry that the course of rising rates would lead to a recession.

The other themes were at odds with one another at times: rising consumer and investor confidence; rising food and gas prices, negative GDP numbers, a cooling-off of the housing market, better than expected manufacturing data; not-so-great corporate earnings, continued supply-chain bottlenecks and more social unrest.

Further, we saw that:

Volatility, as measured by the VIX, trended up this quarter, beginning the quarter under 27 and ending the month over 31, although there was a dip in the middle of the quarter.

West Texas Intermediate crude trended down for the quarter, starting at just over $105/barrel and ending the quarter at just under $80, slightly higher than where it stood one year ago.

Market Performance Around the World

Investors were unhappy with the quarterly performance worldwide, as all 36 developed markets tracked by MSCI were negative for the third quarter of 2022 – with most recording negative returns in the double digits. And for the 40 developing markets tracked by MSCI, 38 of them were negative too, with only the EM Latin America and EFM Latin America and Caribbean Index both gaining about 1%.

Source: MSCI. Past performance cannot guarantee future results

Sector Performance Rotated in Q22022

The overall trend for sector performance for the third quarter was ugly, as 10 of the 11 S&P 500 sectors dropped, with only Consumer Discretionary staying positive. And as if those numbers weren’t bad enough, the performance leaders and laggards rotated throughout the quarter, and the ranges were substantial.

Here are the sector returns for the second and third quarters of 2022:

Source: FMR

Reviewing the sector returns for just the third quarter of 2022 and the first nine months of the year, we saw that:

Almost all sectors were painted red for the third quarter, with only the Consumer Discretionary sector painted green;

2 of the 11 sectors saw double-digit declines in the third quarter, whereas 7 recorded a double-digit decline in Q2;

The interest-rate sensitive sectors (Information Technology, Financials, and Real Estate specifically) struggled as the Fed raised rates; and

The differences between the best (+4%) performing and worst (-13%) performing sectors in the third quarter were big.

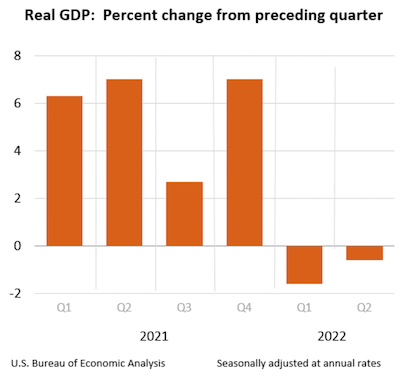

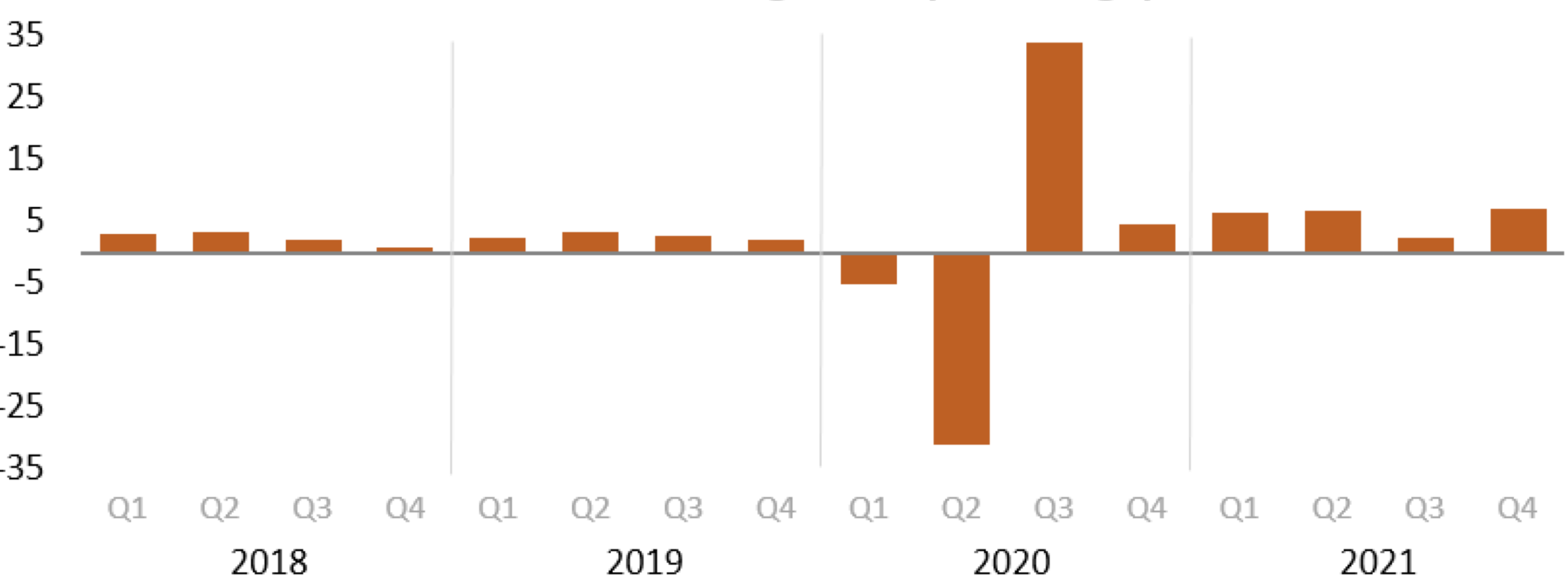

GDP Down in 2nd Quarter

The Bureau of Economic Analysis released its third estimate of 2nd quarter's GDP and announced that it decreased at an annual rate of 0.6%, following a decrease of 1.6% in the first quarter. This third estimate was the same as was announced in the second estimate in August.

The smaller decrease in the second quarter, compared to the first quarter, reflected an upturn in exports and an acceleration in consumer spending.

Profits increased 4.6% at a quarterly rate in the second quarter after increasing 0.1% in the first quarter.

Private goods-producing industries decreased by 10.4%, private services-producing industries increased by 2.0%, and government decreased by 0.2%.

Overall, 9 of 22 industry groups contributed to the second-quarter decline in real GDP.

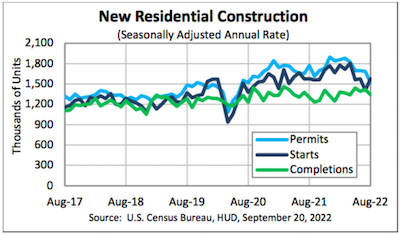

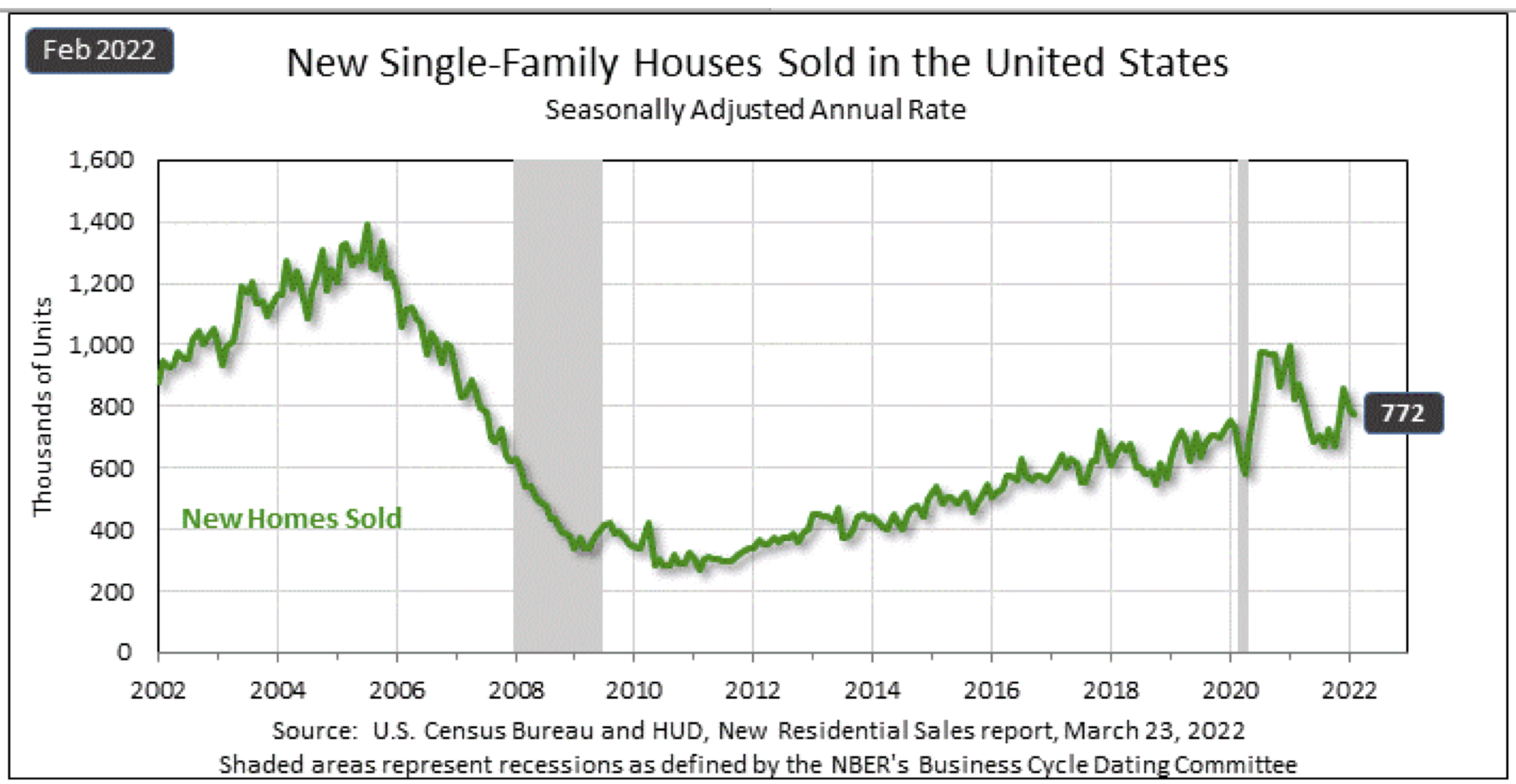

Housing Was Mixed

On September 20th, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential construction statistics for August 2022:

Building Permits

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,517,000.

This is 10.0% below the revised July rate of 1,685,000 and 14.4% below the August 2021 rate of 1,772,000.

Single‐family authorizations in August were at a rate of 899,000; this is 3.5% below the revised July figure of 932,000.

Authorizations of units in buildings with five units or more were at a rate of 571,000 in August.

Housing Starts

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,575,000.

This is 12.2% above the revised July estimate of 1,404,000 but is 0.1% below the August 2021 rate of 1,576,000.

Single‐family housing starts in August were at a rate of 935,000; this is 3.4% above the revised July figure of 904,000.

The August rate for units in buildings with five units or more was 621,000.

Housing Completions

Privately‐owned housing completions in August were at a seasonally adjusted annual rate of 1,342,000.

This is 5.4% below the revised July estimate of 1,419,000 but is 3.1% above the August 2021 rate of 1,302,000.

Single‐family housing completions in August were at a rate of 1,017,000; this is 0.4% above the revised July rate of 1,013,000.

The August rate for units in buildings with five units or more was 318,000.

Mortgage Rates Jump

According to data compiled by Bankrate on the last day of the quarter:

30-year fixed rate: 6.83%

15-year fixed rate: 6.00%

5/1 ARM rate: 5.22%

30-year fixed jumbo fixed rate: 6.81%

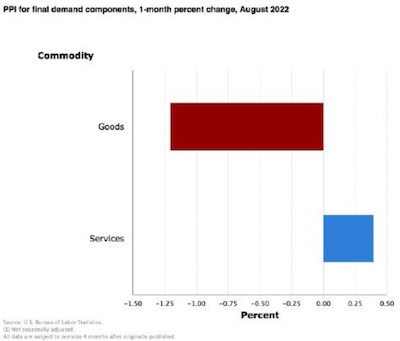

Producer Price Index Drops

The Producer Price Index for final demand fell 0.1% in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported. Final demand prices decreased by 0.4% in July and advanced by 1.0% in June.

On an unadjusted basis, the index for final demand moved up 8.7% for the 12 months that ended in August.

In August, the decrease in the index for final demand is attributable to a 1.2% decline in prices for final demand goods. In contrast, the index for final demand services advanced by 0.4%.

Prices for final demand fewer foods, energy, and trade services moved up 0.2% in August following a 0.1% rise in July.

For the 12 months that ended in August, the index for final demand for fewer foods, energy, and trade services increased by 5.6%.

Final Demand

Final demand goods: The index for final demand goods fell 1.2% in August after declining 1.7% in July. The August decrease can be traced to a 6.0% price drop for final demand energy. Conversely, the index for final demand goods, fewer foods, and energy rose 0.2%, while prices for final demand foods were unchanged.

Product detail: In August, over three-quarters of the decrease in prices for final demand goods is attributable to the index for gasoline, which fell 12.7%.

Prices for diesel fuel, jet fuel, chicken eggs, primary basic organic chemicals, and home heating oil also declined. In contrast, the index for construction machinery and equipment increased by 2.6%. Prices for beverages and beverage materials and for electric power also rose.

Final demand services: The index for final demand services increased by 0.4% in August, the fourth consecutive rise. Sixty% of the August advance can be traced to a 0.8%increase in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand services, less trade, transportation, and warehousing, also moved higher, rising 0.3%. Conversely, the index for final demand transportation and warehousing services decreased by 0.2%.

Product detail: Forty percent of the price increase for final demand services can be attributed to margins for fuels and lubricants retailing, which rose 14.2%. The indexes for securities brokerage, dealing, investment advice, and related services; loan services (partial); transportation of passengers (partial); portfolio management; and chemicals and allied products wholesaling also increased. In contrast, prices for truck transportation of freight decreased by 1.9%. The indexes for guestroom rental and for food and alcohol retailing also fell.

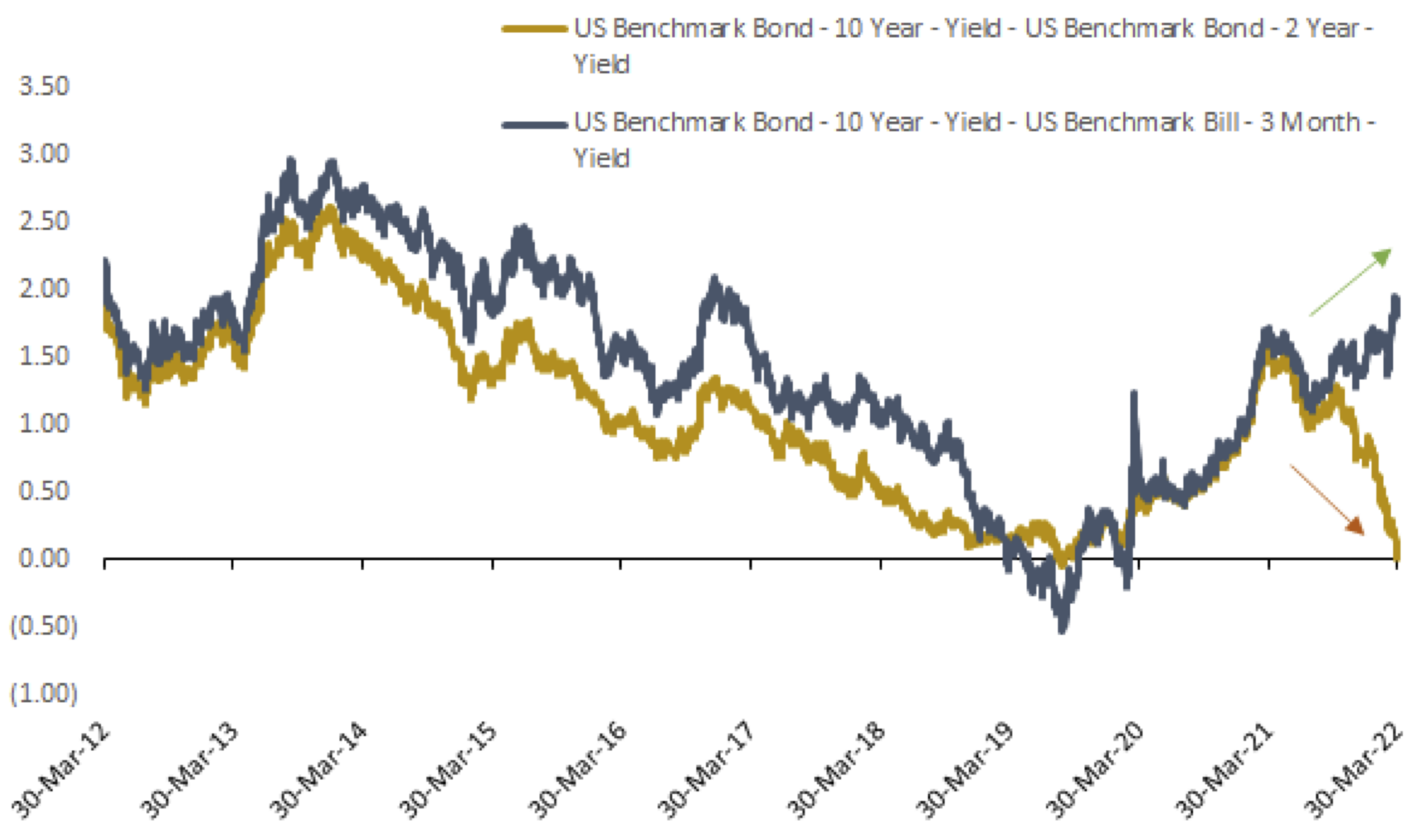

Leading Indicators Drop

The Conference Board Leading Economic Index for the U.S. decreased by 0.3% in August 2022 to 116.2 (2016=100) after declining by 0.5% in July. The LEI fell 2.7% over the six-month period between February and August 2022, a reversal from its 1.7% growth over the previous six months.

From the Conference Board release:

“The US LEI declined for a sixth consecutive month, potentially signaling a recession. Among the index’s components, only initial unemployment claims and the yield spread contributed positively over the last six months—and the contribution of the yield spread has narrowed recently.

“Furthermore, labor market strength is expected to continue moderating in the months ahead. Indeed, the average workweek in manufacturing contracted in four of the last six months—a notable sign, as firms reduce hours before reducing their workforce. Economic activity will continue slowing more broadly throughout the US economy and is likely to contract. A major driver of this slowdown has been the Federal Reserve’s rapid tightening of monetary policy to counter inflationary pressures. The Conference Board projects a recession in the coming quarters.”

Further:

The Conference Board Coincident Economic Index for the U.S. increased by 0.1%in August 2022 to 108.7 (2016=100), after increasing by 0.5% in July.

The CEI rose by 0.6% over the six-month period from February to August 2022, slower than its growth of 1.5% over the previous six-month period.

The Conference Board Lagging Economic Index for the U.S. increased by 0.7% in August 2022 to 115.4

Consumer Confidence Up

The Conference Board’s Consumer Confidence Index increased in September for the second consecutive month. The Index now stands at 108.0 (1985=100), up from 103.6 in August.

The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – rose to 149.6 from 145.3 last month.

The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – increased to 80.3 from 75.8.

Present Situation

Consumers’ appraisal of current business conditions was more favorable in September.

20.8% of consumers said business conditions were “good,” up from 19.0%.

21.2% of consumers said business conditions were “bad,” down from 22.6%.

Consumers’ assessment of the labor market improved.

49.4% of consumers said jobs were “plentiful,” up from 47.6%.

11.4% of consumers said jobs were “hard to get,” down slightly from 11.6%.

Expectations Six Months Hence

Consumers were more positive about the short-term business conditions outlook in September.

19.3% of consumers expect business conditions to improve, up from 17.3%.

21.0% expect business conditions to worsen, down from 21.7%.

Consumers were more optimistic about the short-term labor market outlook.

17.5% of consumers expect more jobs to be available, up from 17.1%.

17.7% anticipate fewer jobs, down from 19.6%.

Consumers were mixed about their short-term financial prospects.

18.4% of consumers expect their incomes to increase, up from 16.6%.

Conversely, 14.3% expect their incomes will decrease, up from 13.9%.

Investor Consumer Rises

“The Global Investor Confidence Index increased to 108.8, up 1.5 points from August’s revised reading of 107.3. The increase was led by a 7.7-point jump in Asian ICI to 100.1. North American ICI rose as well, up 2.4 points to 109. European ICI, meanwhile, fell 5.5 points to 100.1.”

The release further stated:

“Despite heightened equity market volatility experienced globally, risk sentiment expressed by institutional investors remained steady in September as the Global ICI rose slightly to 108.8. As anticipated, European investors were rattled by a continued energy crisis, diminishing growth prospects, and hawkish global central banks; as a result, the EMEA ICI tumbled 5.9 points. Going forward, it will be important to monitor whether the dip in European investor confidence persists, given the market’s negative reaction to the UK’s recent fiscal plans. Overall, the increase in the September Global ICI can be largely attributed to Asia-Pacific investors as risk appetite grew in tandem with the reopening of borders and easing of restrictions in Macau and Chengdu, China.”

Consumer Sentiment

“Consumer sentiment confirmed the preliminary reading earlier this month and was essentially unchanged from the month prior, at less than one index point above August. Buying conditions for durables and the one-year economic outlook continued lifting from the extremely low readings earlier in the summer, but these gains were largely offset by modest declines in the long run outlook for business conditions. As seen in the chart, sentiment for consumers across the income distribution has declined in a remarkably close fashion for the last 6 months, reflecting shared concerns over the impact of inflation, even among higher-income consumers who have historically generated the lion's share of spending.”

The median expected year-ahead inflation rate declined to 4.7%, the lowest reading since last September. At 2.7%, median long run inflation expectations fell below the 2.9-3.1% range for the first time since July 2021. Inflation expectations are likely to remain relatively unstable in the months ahead, as consumer uncertainty over these expectations remained high and is unlikely to wane in the face of continued global pressures on inflation.

Compensation Up

Compensation costs for civilian workers increased 1.3%, seasonally adjusted, for the 3-month period ending in June 2022, the U.S. Bureau of Labor Statistics reported.

Wages and salaries increased 1.4% and benefit costs increased 1.2% from March 2022.

Compensation costs for civilian workers increased 5.1% for the 12-month period ending in June 2022 and increased 2.9% in June 2021.

Wages and salaries increased 5.3% for the 12-month period ending in June 2022 and increased 3.2% for the 12-month period ending in June 2021.

Benefit costs increased 4.8% over the year and increased 2.2% for the 12-month period ending in June 2021.

Sources: bls.gov; umich.edu; census.gov; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com

Partnering with Outside The Box Financial Planning offers numerous benefits for individuals seeking retirement planning, small business support, wealth management, and beyond. With their fiduciary duty, comprehensive approach, unbiased advice, transparent fee structure, and ongoing support, OTBFP act as a trusted advisor who prioritizes your best interests. Click here to schedule a complimentary “Fit” meeting to determine if we would make a good mutual fit.

Remember, financial decisions have long-lasting implications, and working with a professional can provide the expertise and guidance necessary to make informed choices that align with your financial aspirations.

However, if you would like to take a shot at building a financial plan on your own, we offer our financial planning software, RightCapital, free of charge. Click here to get started.