Markets Have Rotten Third Quarter

Global equity markets had a rotten third quarter – especially the smaller-cap and tech names. And the month of September was especially difficult, as volatility increased, oil jumped and the S&P 500 closed out September with 4 consecutive losing weeks.

For the third quarter of 2023:

The DJIA retreated 2.6%;

The S&P 500 lost 3.7%;

NASDAQ declined 4.3%; and

The Russell 2000 dropped 5.9%.

While there was not a lot to celebrate when the third quarter closed, investors are still somewhat encouraged by the YTD numbers as the major equity markets are still in positive territory, albeit barely for the smaller-caps and the mega-caps as:

The DJIA up 1.1% YTD%;

The S&P 500 up 11.7% YTD;

NASDAQ up 26.3% YTD; and

The Russell 2000 up 1.4% YTD.

The themes that drove market performance in the third quarter continued to center around inflation, the Fed, the housing market, and the labor market, as recent numbers suggested that inflation is easing as the Fed paused its rate-hiking trend (at least for now). There was also a lot of encouraging economic data received this quarter as well, including hopeful GDP numbers and consumer sentiment levels.

Further, we saw that:

Volatility, as measured by the VIX, trended up this quarter, beginning the quarter at 13.5 and ending at 17.5, with most of the increase beginning at the end of September.

West Texas Intermediate crude trended up significantly for the third quarter, jumping over $20/barrel from about $70 to over $90, peaking at $93.68/barrel and stoking inflation.

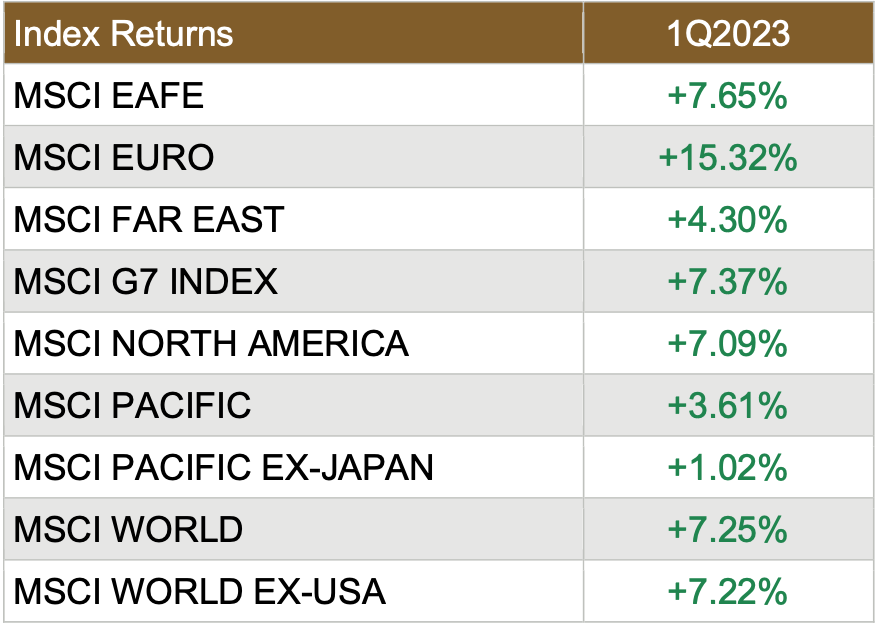

Market Performance Around the World

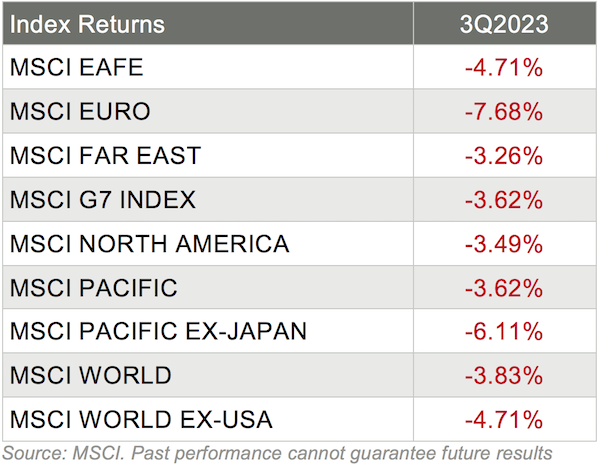

Investors were unhappy with the quarterly performance around the world too, as all 36 developed markets tracked by MSCI were negative for the third quarter of 2023, with 18 losing more than 6%. And for the 40 developing markets tracked by MSCI, only 4 of those were positive, with a great many losing more than 5%.

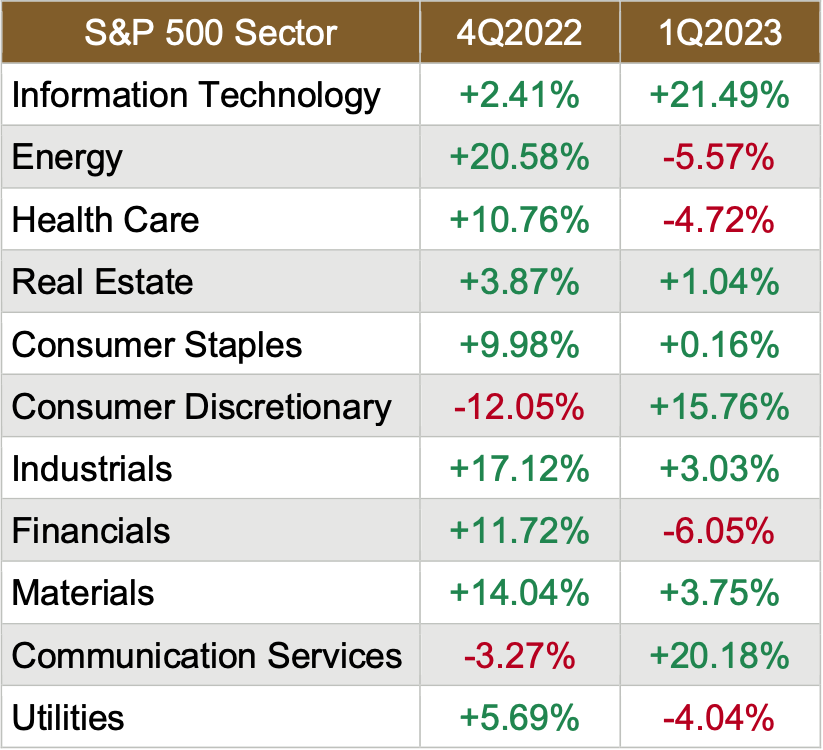

Sector Performance Rotated in 3Q2023

The overall performance for sector performance for the third quarter was poor. In fact, only two sectors advanced as the other 9 sectors declined markedly. Contrast that with the overall performance for sector performance for the second quarter of 2023, which was very good, as 9 of the 11 sectors advanced, with 3 jumping more than 15% .

And interestingly, with the exception of the Energy sector, the other 10 sectors saw relative performance decline from the second quarter to the third quarter, with a few sizable declines – like Information Technology going from +20% to -6% in just a quarter.

Here are the sector returns for the third and second quarters of 2023:

Reviewing the sector returns for just the 3rd quarter of 2023, we saw that:

9 of the 11 sectors were painted red, with the Energy sector making a big leap, driven by rising oil prices;

The defensive-sectors (think Utilities and Real Estate) really struggled during the quarter;

Information Technology saw an especially huge swing and half of the sectors lost more than 5%; and

The differences between the best (+12%) performing and worst (-9%) performing sectors in the first quarter was massive.

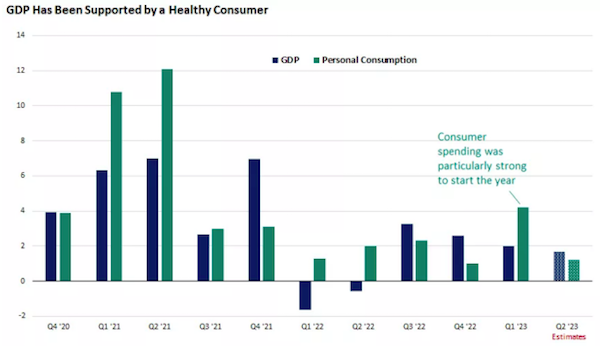

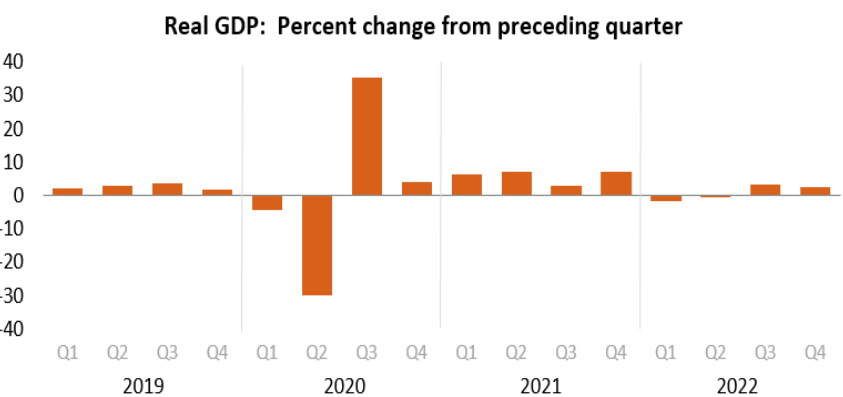

2Q2023 GDP Up 2.1%

The Bureau of Economic Analysis Real reported that Gross Domestic Product increased at an annual rate of 2.1% in the second quarter of 2023. In the first quarter, real GDP increased 2.2%.

“The increase in real GDP reflected increases in nonresidential fixed investment, consumer spending, and state and local government spending that were partly offset by a decrease in exports. Imports decreased.

Compared to the first quarter, the deceleration in real GDP in the second quarter primarily reflected a deceleration in consumer spending, a downturn in exports, and a deceleration in federal government spending that were partly offset by an upturn in private inventory investment, an acceleration in nonresidential fixed investment, and a smaller decrease in residential investment. Imports turned down.”

Fed Holds Rates Steady – For Now

Wall Street and Main Street toggled between hope that the Fed might be done with its rate-hiking and worry from the Fed’s recent and very hawkish comments from its last meeting. And as expected, the big news on the quarter was that the Fed decided to leave its fed funds rate (its short-term lending benchmark) at a target range of 5.25% to 5.50%, the same level established at its July meeting.

But confounding Wall Street was the Fed’s updated Summary of Economic Predictions where another rate hike this year was very much on the table. In addition, the Fed surprised many with an outlook for rates next year that were notably higher than expected as were their 2025 rate predictions.

Inflation Still High

The Consumer Price Index for All Urban Consumers rose 0.6% in August on a seasonally adjusted basis, after increasing 0.2% in July, the U.S. Bureau of Labor Statistics reported. Over the last 12 months, the all items index increased 3.7% before seasonal adjustment.

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase.

Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month.

The energy index rose 5.6% in August as all the major energy component indexes increased.

The food index increased 0.2% in August, as it did in July.

The index for food at home increased 0.2% over the month while the index for food away from home rose 0.3% in August.

The index for all items less food and energy rose 0.3% in August, following a 0.2% increase in July.

Indexes which increased in August include rent, owners’ equivalent rent, motor vehicle insurance, medical care, and personal care.

The indexes for lodging away from home, used cars and trucks, and recreation were among those that decreased over the month.

The all items index increased 3.7% for the 12 months ending August, a larger increase than the 3.2% increase for the 12 months ending in July.

The all items less food and energy index rose 4.3% over the last 12 months.

The energy index decreased 3.6% for the 12 months ending August, and the food index increased 4.3% over the last year.

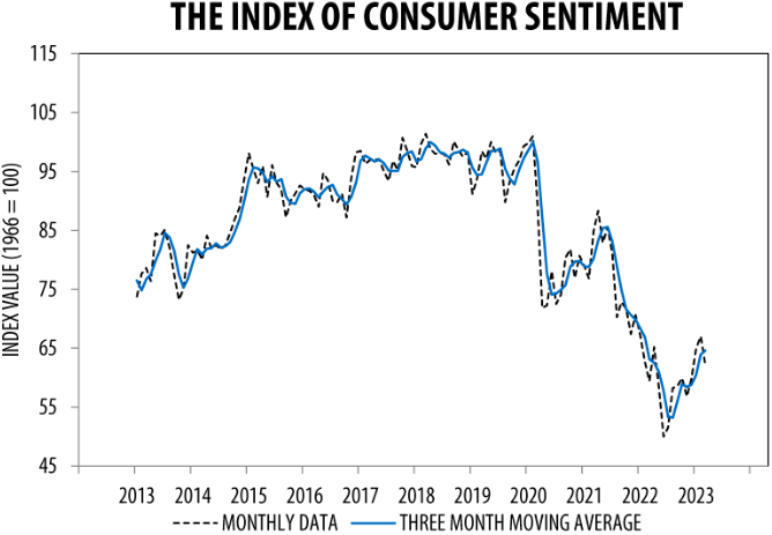

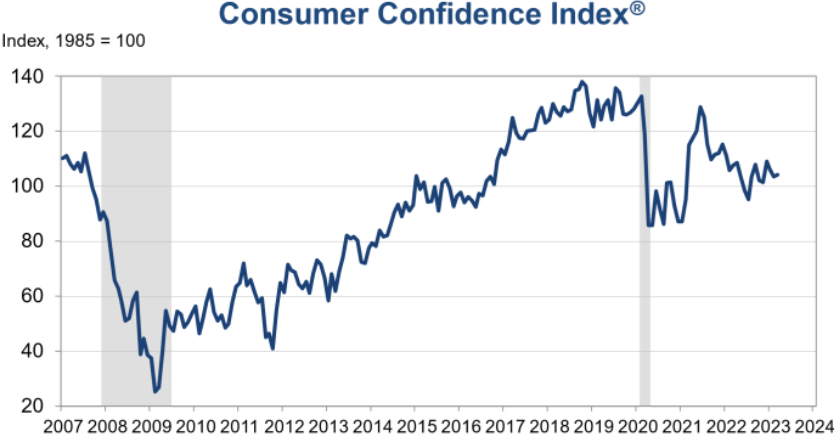

Consumer Confidence Declines Again

The Conference Board Consumer Confidence Index declined again in September to 103.0 (1985=100), down from an upwardly revised 108.7 in August. In addition:

The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – rose slightly to 147.1 (1985=100) from 146.7.

The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – declined to 73.7 (1985=100) in September, after falling to 83.3 in August.

Expectations fell back below 80 – the level that historically signals a recession within the next year. Consumer fears of an impending recession also ticked back up, consistent with the short and shallow economic contraction we anticipate for the first half of 2024.

“Consumer confidence fell again in September 2023, marking two consecutive months of decline. September’s disappointing headline number reflected another decline in the Expectations Index, as the Present Situation Index was little changed. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular. Consumers also expressed concerns about the political situation and higher interest rates. The decline in consumer confidence was evident across all age groups, and notably among consumers with household incomes of $50,000 or more.”

Assessment of Family’s Current Finances

Consumers’ assessment of their Family’s Current Financial Situation turned more negative in September.

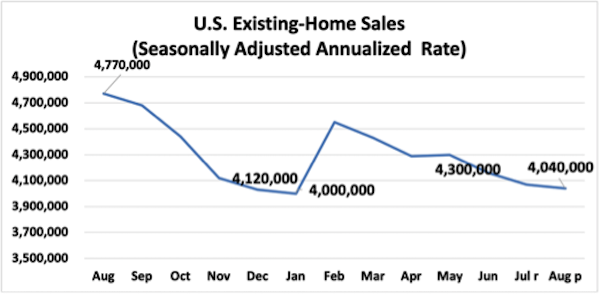

Existing Home Sales Drop

“NAR released a summary of existing-home sales data showing that housing market activity this August declined 0.7% from July 2023. August’s existing-home sales reached a 4.04 million seasonally adjusted annual rate. August’s sales of existing homes weakened by 15.3% from August 2022.

The national median existing-home price for all housing types reached $407,100 in August, up 3.9% from a year ago.

Regionally, all four regions showed price growth from a year ago in August. The Midwest had the most significant gain of 6.8%, followed by the Northeast with an increase of 5.8%. The South increased 3.2%, while the West region rose 1.0%.

August’s inventory of unsold listings as of the end of the month was down 0.9% from last month, standing at 1,100,000 homes for sale. Compared with August of 2022, inventory levels were down 14.1%. It will take 3.3 months to move the current inventory level at the current sales pace, well below the desired pace of 6 months. Inventory conditions continue to be a challenge for potential home buyers.

It takes approximately 20 days for a home to go from listing to a contract in the current housing market. A year ago, it took 16 days.

From a year ago, all four regions had double-digit declines in sales in August. The Northeast had the most significant dip of 22.6%, followed by the Midwest, which fell 16.4%. The West decreased 15.7%, followed by the South, down 12.4%.

Compared to July 2023, two of the four regions showed declines in sales. Only the Midwest had an incline of 1.0%. The West region had the biggest drop in sales of 2.6%, followed by the South with a dip of 1.1%. The Northeast region was flat from last month.

The South led all regions in percentage of national sales, accounting for 45.5% of the total, while the

In August, single-family sales decreased 1.4%, and condominium sales were down 4.8% compared to last month. Single-family home sales were down 15.3%, while condominium sales fell 15.4% compared to a year ago. The median sales price of single-family homes rose 3.7% to $413,500 from August 2022, while the median sales price of condominiums increased by 6.2% to $333,900.”

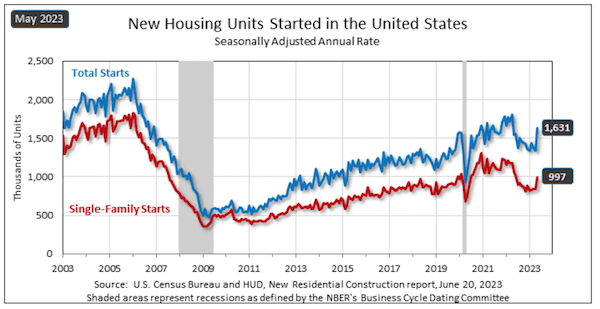

Builder Confidence Wanes

This is on the heels of the National Association of Home Builders reporting that: “builder confidence in the market for newly built single-family homes in September fell five points to 45, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index. This follows a six-point drop in August.

From the NAHB release: “As mortgage rates stayed above 7% over the last month, more builders are reducing home prices again to bolster sales. In September, 32% of builders reported cutting home prices, compared to 25% in August. That’s the largest share of builders cutting prices since December 2022 (35%). The average price discount remains at 6%. Meanwhile, 59% of builders provided sales incentives of all forms in September, more than any month since April 2023.”

Durable Goods Orders Up

New Orders New orders for manufactured durable goods in August, up five of the last six months, increased $0.5 billion or 0.2 percent to $284.7 billion, the U.S. Census Bureau announced. This followed a 5.6 percent July decrease.

Excluding transportation, new orders increased 0.4 percent.

Excluding defense, new orders decreased 0.7 percent.

Machinery, up four of the last five months, led the increase, $0.2 billion or 0.5 percent to $37.8 billion.

Investor Confidence Index Inches Up

State Street Global Markets released the results of the State Street Investor Confidence Index for September 2023.

“The Global Investor Confidence Index increased to 108.7, up 0.9 points from August’s revised reading of 107.8. The increase in Investor confidence was driven by a 11.0 point jump in Asian ICI to 112.6, and, to a lesser extent, a 0.8 point rise in North American ICI to 104.7. European ICI, meanwhile, declined 6.2 points to 97.5.”

Sources: conference-board.org; nar.realtor; census.gov; bls.gov; nahb.org; statestreet.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com; census.gov

Copyright © 2023 Financial Media Exchange LLC. All rights reserved.

Distributed by Financial Media Exchange.