Global Market Commentary: First Quarter 2022

Markets Have Terrible Second Quarter

Global equity markets had an awful second quarter, and when the final Wall Street bell weakly tolled on June 30th, all major global equity markets were in the red, leading to overall market declines not seen in decades.

To underscore how bad it has been so far in 2022, consider that the S&P 500 recorded its worst first six months in 52 years, and the DJIA recorded its worst first six months since 1962.

For the second quarter of 2022:

The DJIA dropped 11.2%;

The S&P 500 lost 16.7%;

NASDAQ plummeted 22.7%; and

The Russell 2000 declined 18.4%.

The themes that drove market performance in the second quarter were the same worries that drove markets in the first quarter and towards the end of last year. And the two most dominant themes continue to be inflation and the Fed – with the former rising to 40-year highs and the latter causing Wall Street to worry that the course of rising rates would lead to a recession.

The other themes were plummeting consumer confidence, rising food and gas prices, negative GDP numbers, declining manufacturing, a cooling-off of the housing market, not-so-wonderful corporate earnings, continued supply-chain bottlenecks, and a lot of social unrest here at home.

Further, we saw that:

Volatility, as measured by the VIX, trended up significantly this quarter, beginning around 19 and ending the month just south of 29.

West Texas Intermediate crude trended up slightly for the quarter, starting at just under $100/barrel and ending at over $105. For perspective, WTI started 2022 at about $75/barrel.

Market Performance Around the World

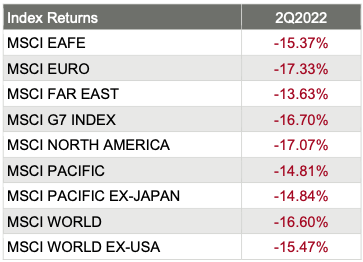

Investors were unhappy with the quarterly performance around the world, as all 36 developed markets tracked by MSCI were negative for the second quarter of 2022 – and all of them saw negative returns in the double digits. And for the 40 developing markets tracked by MSCI, 39 of them were negative, with many losing more than a quarter of their value.

Source: MSCI. Past performance cannot guarantee future results

This Bear Seems Especially Angry

U.S. equity markets turned in a terrible second quarter to add to a not-so-great first quarter, pushing the major equity markets to levels not seen in a long time. And while many are suggesting that there is more pain to come from this bear, plenty of others suggest that the worst is behind us. But we of course, won’t know for sure for another six months.

For the YTD through the end of June:

The DJIA is down 15.9%;

The S&P 500 is down 21.0%;

NASDAQ is down 30.3%; and

The Russell 2000 is down 24.8%.

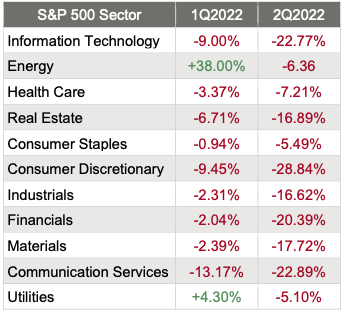

Sector Performance Rotated in Q22022

The overall trend for sector performance for the second quarter and the YTD was ugly, as all 11 S&P 500 sectors dropped for the second quarter, and only the Energy sector was positive YTD. As if those numbers weren’t bad enough, the performance leaders and laggards rotated throughout the quarter, and the ranges are substantial.

Here are the sector returns for the first two quarters of 2022:

Reviewing the sector returns for just the second quarter of 2022 and the first six months of the year, we saw that:

All sectors were painted red for the second quarter, and only the Energy sector is green YTD;

7 of the 11 sectors saw double-digit declines in the second quarter, and those same 7 saw double-digit declines YTD too;

The defensive sectors (Utilities and Consumer Staples) turned in a relatively decent quarter and have held up relatively ok YTD;

The interest-rate sensitive sectors (Information Technology and Financials specifically) struggled as the Fed raised rates; and

The differences between the best (-5%) performing and worst (-29%) performing sectors in the first quarter were big.

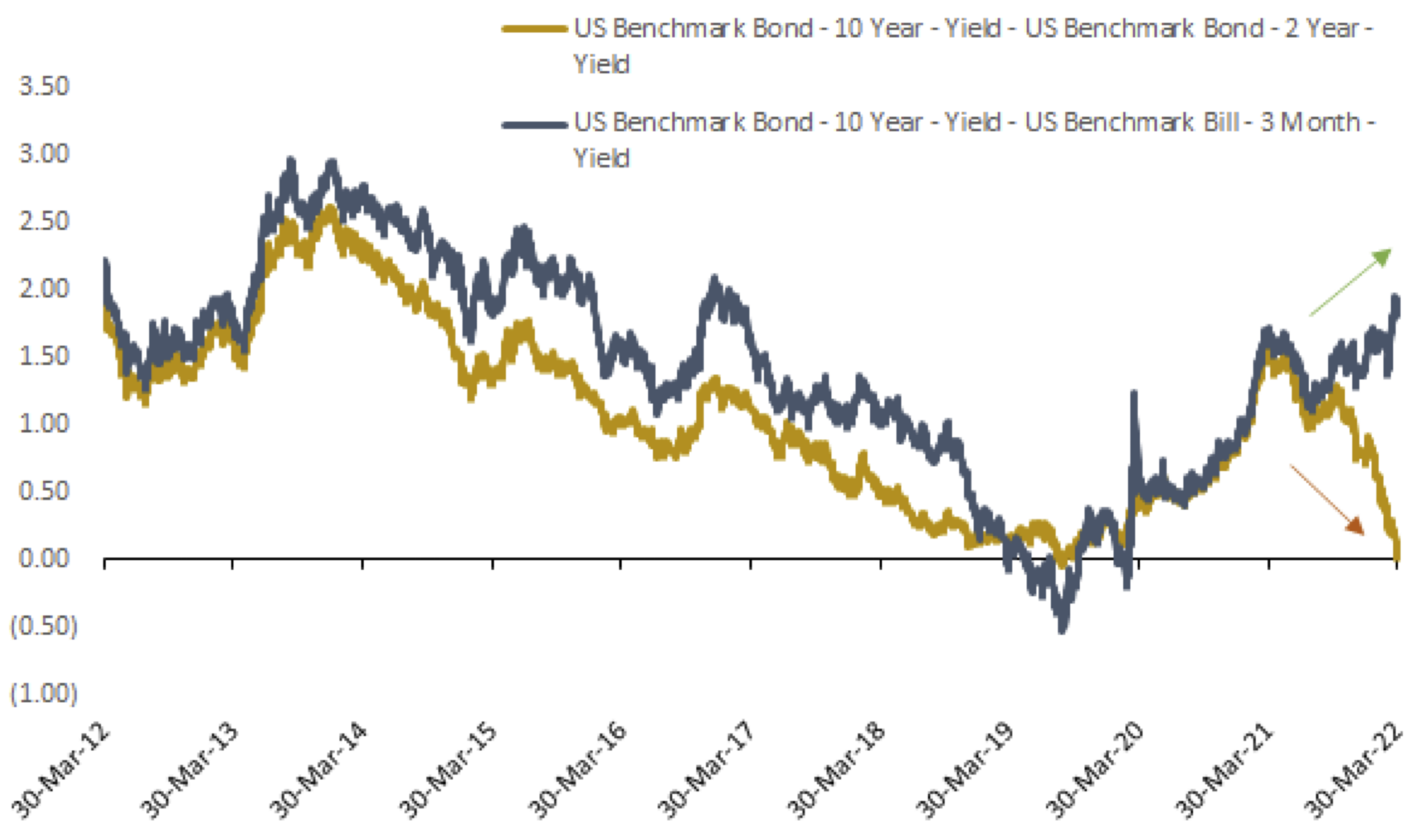

The Fed, The Fed, The Fed

The Federal Reserve voted to increase the fed funds by an amount not seen in almost 30 years. From the Federal Reserve press release dated June 15, 2022:

“Overall economic activity appears to have picked up after edging down in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1.5% - 1.75% and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that was issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.”

Like the previous hike earlier this year, this rate hike was one of the most predictable and predicted rate movements the markets have ever seen. However, the magnitude of the rate hike was not predicted.

“Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” said Fed Chair Jerome Powell. And Powell also said that decisions will be made “meeting by meeting.”

Interestingly, as of the day after the Fed’s historic announcement, Wall Street assigned a probability of more than 80% that the Fed would raise rates by another 75 basis points at their next meeting at the end of July. And that probability has held steady through the end of June too.

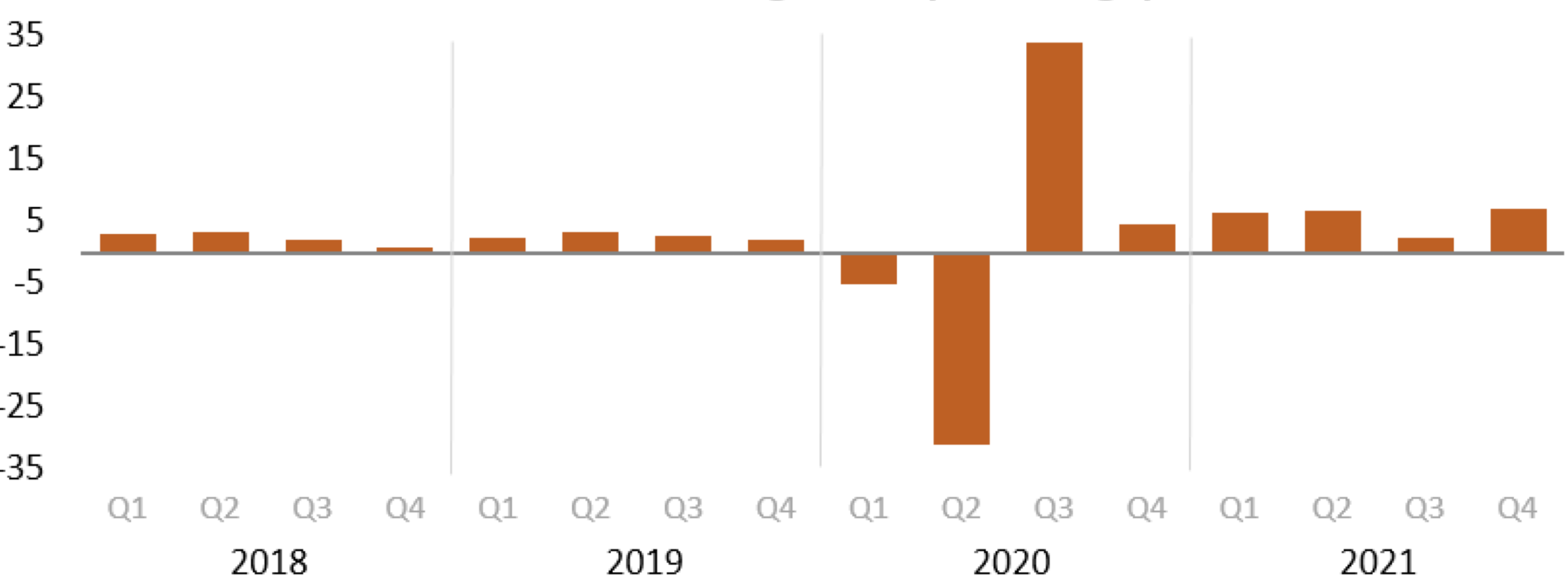

GDP Slumps

As the quarter wound down, the Bureau of Economic Analysis released its 3rd estimate of 1st quarter GDP and reported that real gross domestic product decreased at an annual rate of 1.6%. Analysis. In the fourth quarter of 2021, real GDP increased 6.9%.

This 3rd estimate was notable in that the 2nd estimate issued last month reported that GDP declined 1.5%.

U.S. Bureau of Economic Analysis. Seasonally adjusted at annual rates.

“The update primarily reflects a downward revision to personal consumption expenditures (PCE) that was partly offset by an upward revision to private inventory investment (refer to "Updates to GDP").

The decrease in real GDP reflected decreases in exports, federal government spending, private inventory investment, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Nonresidential fixed investment, PCE, and residential fixed investment increased.”

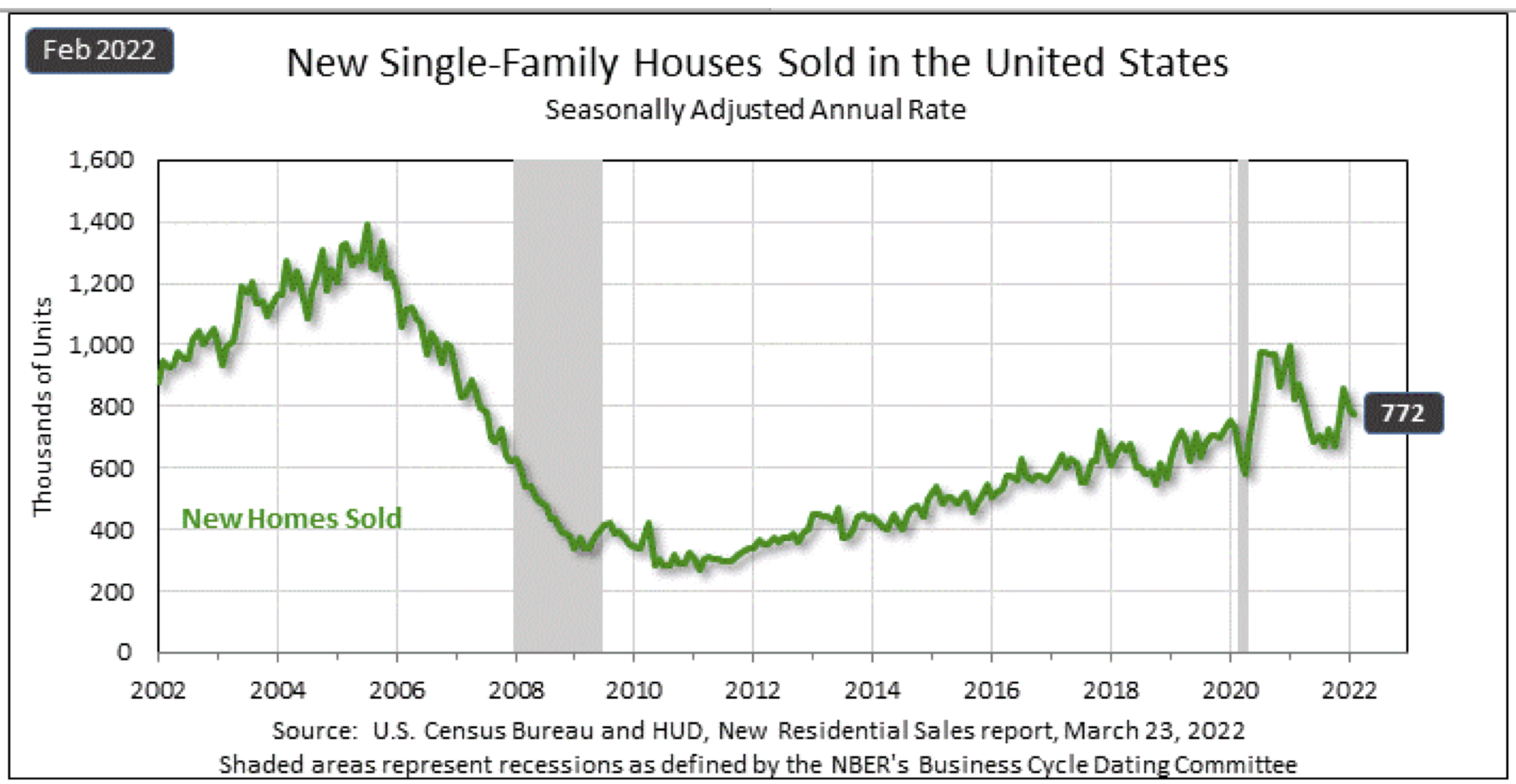

Housing Cools Off

The National Association of Realtors announced that existing-home sales retreated for the fourth consecutive month in May. Month-over-month sales declined in three out of four major U.S. regions, while year-over-year sales slipped in all four regions.

From the release:

Total existing-home sales (completed transactions that include single-family homes, townhomes, condominiums, and co-ops) fell 3.4% from April.

Year-over-year sales receded by 8.6%.

"Home sales have essentially returned to the levels seen in 2019 – prior to the pandemic – after two years of gangbuster performance. Also, the market movements of single-family and condominium sales are nearly equal, possibly implying that the preference towards suburban living over city life that had been present over the past two years is fading with a return to pre-pandemic conditions."

Total housing inventory registered at the end of May increased by 12.6% from April but dropped 4.1% from the previous year.

Unsold inventory sits at a 2.6-month supply at the current sales pace, up from 2.2 months in April and 2.5 months in May 2021.

"Further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year. Nonetheless, homes priced appropriately are selling quickly, and inventory levels still need to rise substantially – almost doubling – to cool home price appreciation and provide more options for home buyers."

The median existing-home price for all housing types in May was $407,600, up 14.8% from May 2021, as prices increased in all regions.

This marks 123 consecutive months of year-over-year increases, the longest-running streak on record.

Further:

Properties typically remained on the market for 16 days in May, down from 17 days in April and 17 days in May 2021.

Eighty-eight percent of homes sold in May 2022 were on the market for less than a month.

The largest year-over-year median list price growth occurred in Miami (+45.9%), Nashville (+32.5%), and Orlando (+32.4%). Austin reported the highest growth in the share of homes that had their prices reduced compared to last year (+14.7 percentage points), followed by Las Vegas (+12.3 percentage points) and Phoenix (+11.6 percentage points).

Regional Breakdown

Existing-home sales in the Northeast climbed 1.5% but fell 9.3% from May 2021. The median price in the Northeast was $409,700, a 6.7% rise from one year ago.

Existing-home sales in the Midwest dropped 5.3% from the previous month and also fell 7.5% from May 2021. The median price in the Midwest was $294,500, up 9.5% from one year before.

Existing-home sales in the South declined 2.8% in May and fell 8.4% from the previous year. The median price in the South was $375,000, a 20.6% jump from one year ago. For the 9th consecutive month, the South recorded the highest pace of price appreciation relative to the other three regions.

Existing-home sales in the West slid 5.3% in May and dropped 10.0% from this time last year. The median price in the West was $633,800, an increase of 13.3% from May 2021.

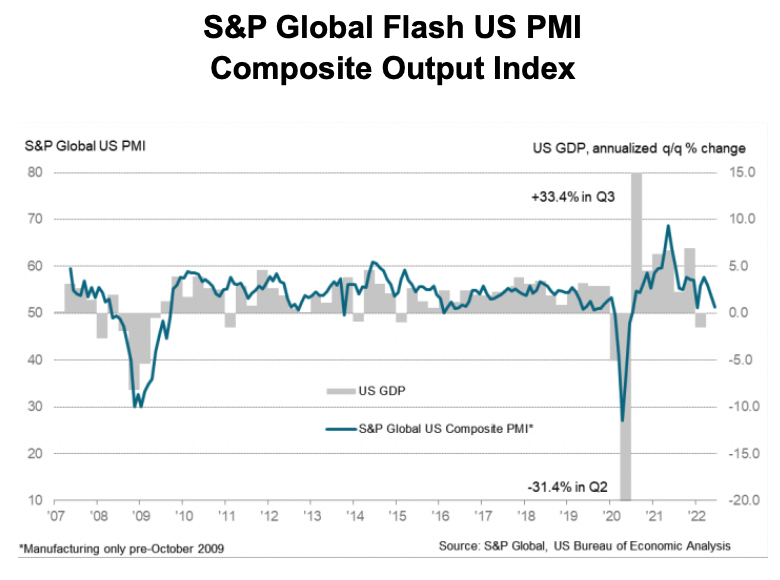

Manufacturing Cools Off

S&P Global reported that we saw “the weakest upturn in US private sector output since January’s Omicron-induced slowdown in June. The rise in activity was the second-softest since July 2020, with slower service sector output growth accompanied by the first contraction in manufacturing production in two years.

The headline Flash US PMI Composite Output Index registered 51.2 in June, down from 53.6 in May. The decline in the index reading signaled further easing in the business activity expansion rate to a pace notably slower than March’s recent peak. Although service providers continued to indicate a rise in output, it was the weakest increase in five months.

Manufacturers fared worse, with factory production slipping into decline as the respective seasonally adjusted index fell to a degree only exceeded twice in the 15-year history of the survey, at the height of the initial pandemic lockdowns in 2020 and the height of the global financial crisis in 2008.

Weaker demand conditions, often linked to the rising cost of living and falling confidence, led to the first contraction in new orders since July 2020. Decreases in new sales for goods and services in June were the first recorded since May and July 2020, respectively.

Similarly, new export orders contracted at the steepest pace since June 2020 as foreign customers paused or reduced new order placements due to inflation and supply chain disruptions.

Inflationary pressures remained marked in June, as input costs and output charges rose substantially again. Although the pace of input price inflation eased to the slowest for five months, it was sharper than any seen before April 2021. Alongside food, fuel, transportation, and material price hikes, firms often mentioned that wages had increased to entice workers to stay, which added pressure to operating expenses.

Finally, business confidence slumped to one of the greatest extents seen since comparable data were available in 2012, down to the lowest since September 2020. Manufacturers and service providers were far less upbeat regarding the outlook for output over the coming year than in May, principally amid inflationary concerns and the further impacts on customer spending as well as tightening financial conditions.

Consumer Sentiment Hits Record Low

The University of Michigan’s Consumer Sentiment Index for June came in 14.4% below May for the lowest reading on record.

“Consumers across income, age, education, geographic region, political affiliation, stockholding, and homeownership status all posted large declines. About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009. Inflation continued to be of paramount concern to consumers; 47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession.”

Orders for Durable Goods Up

Four days before the end of the quarter, the U.S. Census Bureau announced the May advance report on durable goods manufacturers’ shipments, inventories, and orders:

New Orders

New orders for manufactured durable goods in May increased by $1.9 billion or 0.7%.

Up seven of the last eight months, this increase followed a 0.4% April increase.

Excluding transportation, new orders increased by 0.7%.

Excluding defense, new orders increased by 0.6%.

Transportation equipment increased by $0.7 billion or 0.8% for two consecutive months to $87.6 billion.

Shipments

In May, up twelve of the last thirteen months, shipment of manufactured durable goods increased by $3.6 billion or 1.3% to $268.4 billion.

This followed a 0.3% April increase.

Up seven of the last eight months, transportation equipment led the increase, $1.7 billion or 2.1% to $84.7 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in May, up twenty-one consecutive months, increased $3.7 billion or 0.3% to $1,109.8 billion.

This followed a 0.5% April increase.

Up fifteen of the last sixteen months, transportation equipment led the increase, $2.9 billion or 0.5% to $639.8 billion.

Inventories

Inventories of manufactured durable goods in May, up sixteen consecutive months, increased $2.7 billion or 0.6% to $482.7 billion.

This followed a 0.9% April increase.

Up nineteen consecutive months, Machinery led the increase, $1.0 billion or 1.2% to $82.3 billion.

Capital Goods

Non-defense new orders for capital goods in May increased by $0.4 billion or 0.5%.

Shipments increased by $1.3 billion or 1.6%.

Unfilled orders increased by $3.9 billion or 0.6%.

Inventories increased by $0.6 billion or 0.3%.

In May, defense orders for capital goods increased by $0.3 billion or 2.6%.

Shipments increased by $0.3 billion or 2.5%.

Unfilled orders decreased by $0.2 billion or 0.1%.

Inventories increased by $0.1 billion or 0.3%.

Sources: bea.gov; census.gov; nar.realtor; umich.edu; spglobal.com; msci.com; fidelity.com; nasdaq.com; wsj.com; morningstar.com